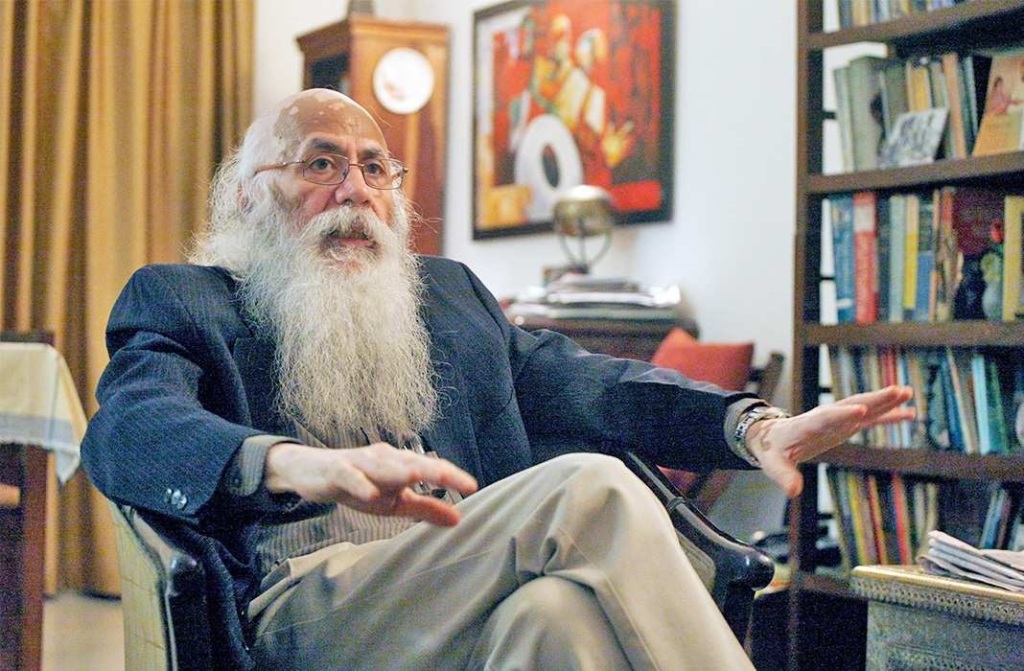

COVID-19 induced lockdown is a voluntary cessation of economic activity, Prof Arun Kumar, one of India’s most eminent economist, said while addressing the audience in a Distinguished Lecture #WebPolicyTalk organized by Impact and Policy Research Institute (IMPRI), New Delhi on Socio-Economic Impact of Coronavirus Pandemic in India held on October 7, 2020. Prof Kumar is Malcolm S. Adiseshiah Chair Professor, Institute of Social Sciences, New Delhi and former Professor, Jawaharlal Nehru University (JNU), New Delhi and is known for his works on Indian economy, black money and policy issues. An IMPRI note:

Referring to lockdown scenarios of empty roads, decline in consumption of petrol and diesel by more than 30% and drastic fall in air and water pollution, he said everything came to a standstill barring the meagre movement of essentials. He stated that if lockdown would not have been imposed then it would have caused higher mortalities than the current rate due to inadequate medical facilities in India. Though it is not a solution to the problem but was necessary to prevent societal collapse until vaccines and medical facilities are developed. He opined that the apex number of mortalities should be lower than the medical capacity like in the countries of Italy and Spain.Unlike World War and Global Financial Crisis of 2008 when employment was full and demand was short and production was shifted to other goods, lockdown led to mass unemployment of around 122 million workers in India, according to the CMIE. As per Prof. Kumar’s calculations, this figure stands at over 200 million, incorporating the unorganised sector. He suggested that CMIE needs to reconsider its sample since many workers migrated to their natives and thus was the reason for this underestimation. In the USA, 44 million people joined unemployment rolls and availed benefits. The amount of work affected must be considered along with unemployment, for instance, due to unemployment, demand fell drastically and supply froze due to restricted movements. This hit the poor people the most as they work and buy on a daily basis. As soon as income stopped, people started starving and thus desperately moving to rural areas walking hundreds of miles with their luggage and children.

To implement lockdown in a poor developing country, characterised by congestion, lack of essential supplies, isolation is a dream, there was a need to decongest the localities by opening schools, parks, community halls; allowing people to migrate after successful testing; essentials such as water, energy, etc. should have been provided at the place of current residence to prevent them from moving out of their safety nests.

Prof. Kumar explained the vicious circle of disruptions in supply chain in India and the world, which led to massive losses for the businesses. Due to restrictions on transportation, trade, finance and working capital, the operations of machines and supplies of raw materials and sales of output disrupted leading to piling up of inventories, thereby increasing costs. Though we had both workers and capital, still production stalled. Due to halted sales and thus revenues, interest payments burdened the balance sheets and businesses failed. When production continues, sales stops, more working capital is required and more interest is to be paid on working capital. As a result, production stopped and losses mounted for companies.

In the current times, it is seen that healthy companies are using their reserves, weak companies with no reserves are defaulting on their loans and interest payments. This has forced the banks to dissave, since they are not able to pay their depositors. This shows that everyone is dissaving, eventually collapsing the resources of the economy (except for producers of essential items).

While explaining the investment component of national income, Prof. Kumar said that working capital is a part of investment which is necessary for production which results in income. Thus, when production falls, income reduces and thus demand declines. This makes the production capacity idle and investment freezes leading to further decline in income and consumption trapping the economy further into a vicious circle.

He highlighted the ineffective policies of the Reserve Bank of India (RBI) using interest rate cards to boost economic activities in the country since February which eventually failed. It needs to be understood that when businesses are shut and production is stalled, then credit demand will not increase. This has led to surplus liquidity with commercial banks amounting to 8 lakh crores as deposited with RBI by the banks. India is having more liquidity as compared to the pre-demonetization period but due to reduced velocity of circulation of money because of reduced economic activities, liquidity is in vain.

Prof. Kumar said that the impact of COVID-19 on the unorganized sector was immense. 94% of the employment in this sector yields 45% of the output and have low and negligible savings. But when income fell for these 94% of the population during the lockdown, demand for essentials such as agricultural produce fell, as there was very little or no savings. There are over 6 crore enterprises majorly comprising micro units which had exhausted the savings quickly and are unable to restart. The situation is similar for self-employed like traders, mason, taxi and auto drivers, etc. Having the largest unorganized sector in the world, the situation is very difficult and worrisome. Prof. Kumar remarked that the unorganized sector is residual for policymakers and hence does not receive ample attention. In GDP calculation, it is assumed that the unorganized sector is growing at a similar rate as the organized sector leading to overestimation of GDP.

Organized sector, having security and fixed income also showed 19 million lost employment during lockdown as per CMIE. Many people were fired and most lost their part of salaries. Due to lesser incomes, they reduced the consumption of discretionary items but continued with the consumption of essentials. Companies were dissaving due to halted production, thus they provided salaries for March and April but could not do so for May and June. Self-employed in the organized sector such as elderly and retired people were surviving off their savings. The effect on the stock market was negligible since pharmaceuticals, FMCG companies were rising and other companies were falling. Though the rise was narrow. But the wealth-effect was evident when well off people decreased their consumption and investment due to the fall of other companies and sectors such as real estate etc. when the affluent people felt that their wealth was dissipating.

All segments of societies reduced consumption and investment impacting demand and supply in the economy and as a result the businesses would fail. According to the All India Manufacturer Organization, 30% of the businesses will fail. Similarly, Confederation of All India Traders Association argued that 30% of the small traders will fail in the economy. Business failure is likely to be large in the coming year. There are high chances for high leverage firms who have a high ratio of debt against their equity. He recalled the Lehman moment when interconnected financial firms failed subsequently. He highlighted that government policy of a moratorium period of 6 months is temporary relief, but the interests are accumulating. The commercial banks now fear that the NPAs would further rise.

Coming to the agricultural sector, the decline in demand for agricultural produce led to increased rotting of these perishable goods during lockdown. With the closed mid-day meal programmes and with the unfounded fears of contracting virus from chicken and eggs, these goods rot. This led to rise in prices in urban areas and decline in prices in rural areas. He suggested that there was a need for extended procurement and supply in urban areas to halt the increased prices.

He feared a second wave of COVID-19 during the winters, while the numbers in the first round are soaring due to lack of testing facilities. Since vaccine will take time, the consumption and investment would remain low. Production can undergo a V shaped recovery as claimed by the Ministry of Finance, but Prof. Kumar believed that this was unlikely because there are real costs attached to economic activity where businesses have exhausted working capital and banks’ own financial conditions are deteriorating, therefore the recovery is expected to be a K shape wherein some sectors like IT will do good and others such as tourism will be heavily affected. He explained that the slower the rate of recovery of the economy and more negative would be the GDP growth rate. In Prof. Kumar’s own estimates, the decline was around 50% instead of 23% in the output of the economy as claimed by NSO data.

The GDP in April 2020 was 25% less compared to the GDP of 2019. So, with an optimistic assumption that if the economy falls by 30% then GDP will come down to 145 lakh crores from 204 lakh crore as estimated last year. Unfortunately, this year’s calculations are based on 204 lakh crores instead of 145 lakh crores. Last year’s GDP is difficult to achieve this year. So, the additional investment required to build health infrastructure and provide unemployment support to the poor should come from this 145-lakh crore of the economy.

When the economy declines, so does the tax collections. This year’s budget was based on expectation that the economy will grow at 10%, but as the economy fell by 30%, the tax collections collapsed by more than 40%, as per Prof Kumar’s estimations. Revenues of states and centre will fall to 12% of GDP from 16.5%. The current expenditure plans by governments are unsustainable and new expenditure plans would only add to miseries. Government has obligations of past such as interest payments which cannot be withheld, and thus to meet these expenses, the government must reduce the expenses of salaries, defence, travels and meetings etc. Another way is to reduce expenses on new projects and postpone public investments, but this will further reduce the demand. Fiscal deficit is bound to increase owing to revenues shortages.

He commented that the package of 20 lakh crore announced by the government is supply oriented. Only 2 lakh crores are coming from the budget and the rest amount is dependent upon loans and credibility, for instance, the Minister of Finance mentioned that 8 lakh crores would come from RBI liquidity. He opined that immediate relief is only 2 lakh crore which is very small against 18 lakh crore that is required. Further, the supply side responses are for the medium- and long-run and not short-run, which is an immediate requirement. Prof. Kumar was critical of the privatisation of the public sector as it was a pro-corporate step with requirement of strengthening of the public sector. Merging of micro units with medium and large units will only benefit the latter under the fiscal package of 3 lakh crore.

Atma Nirbhar Bharat contradicts its own objective of attracting foreign capital. Corporatization of agriculture with the family of three bills will put the farmers into misery since corporates will traders will be aggregators. There will be double margins squeezing out small farmers.

The ethical aspects of the coronavirus pandemic are that the marginalized are pushed farther than the margin and they are not able to cope with crisis. Cottage sector will be affected badly. Policymakers are always focused on short- and medium-term solutions for organized sector.

Series of initiatives such as demonetization, NBFC crisis and digitization of the economy have always affected the marginalized. Policymakers have seen informal workers as labourers for homes and businesses and act as reserve army of labour so as to keep the wages down in the organized sector and economy. This leads to a situation where masses of people in the unorganized sector do not have living wages and they live in deplorable conditions. Since viruses keep coming, there is a need for survival package. But the survival package is designed in such a way that workers migrated back to cities. The cheap labour for homes and businesses attracted them since the MGNREGA scheme is not strengthened. Workers are in a limbo since neither cities’ have started work nor rural have work opportunities. This is further increasing the marginalization in employment, education and health.

While suggesting a way ahead, he highlighted that while restarting the economy, the full capacity level of the economy will be lower than pre-pandemic levels and people have to maintain physical distancing. Resource generation would be less. Poor and the unorganized sector need support through an expanded public distribution system. There is a need for collectively tackling alienation of the marginalization. Disease does not respect boundaries; thus, vaccination is required for all including the marginalized. There is a need to step up the health infrastructure. Public goods are to be provided in the country by spending more on education, water etc., to prevent societal crisis. Resource position of governments is poor, thus, there is a need to redo the budget. Since the centre and states both are suffering, they need to focus on the survival package.

Once the pandemic is tackled, there is a need to rethink the basic development paradigm to tackle inequality, nature of trade, environment and openness of the economy. There is a need for robust opposition that forces to rethink new ideas which is decimated now. He further added that to have an independent policy for poor in India, we have to come out of the grip of international finance capital since financial sector controls the economic fluctuations. Capital is dominant in nature since it is more mobile than labour.

Post-pandemic situation will have more unemployment since companies will adopt a lot of automation and many companies will feel that they would need less workers. Disparities will increase in education and health due to increasing digitization. Women will be worst sufferers leading to decreasing workforce participation. Violence against women is an emerging facet. Prof. Kumar said that the consumption basket is more about essentials rather than non-essentials. Data reveals that wholesale price index is declining and consumer price index is rising creating temporary inflation situation, suggesting that the traders are hoarding and cornering profits at the expense of consumers. Nonetheless, owing to the demand situation there is threat of deflationary situation in coming times. Suggesting the way forward Prof Kumar highlighted that the Government can issue a COVID-19 bonds to immediately raise the money and also utilise around 8 lakh crore liquidity of funds with banks, for the immediate expenditure needed for the ailing economy, combat the pandemic and provide dignified lives and livelihoods to the citizens, in the New Normal. Lastly, he highlighted the role of political scientists and politics to lead towards the stipulated changes for the betterment of Indian economy and society.

***

|

He said that there is an inherent contradiction between demand and supply as supply always focused on giving something. The supply side has two languages- patronage and entitlements/rights. In contrast, demand has involved the usage of normative language because demand guarantees us a sense of dignity. However, the demands have to reasonable and achievable. He also raised an important point that with the help of policy incentives and intervention we now have to focus on “reshuffling of language” vis-à-vis to the reshuffling of funds, owing to the rich deep-rooted economic theories which Indian scholars are well versed with.

He opined that this pandemic has given us an excellent opportunity to make a distinction between the kind of “language” we will produce while contradicting demand and supply. Prof. Guru even said that COVID-19 has offered us an opportunity to distinguish between the demand and supply as well as produce and create some of the brilliant ideas in terms of innovation.

Other participants to the webinar included- Prof Gopal Guru (Editor, Economic and Political Weekly (EPW); Professor (Retd.), Jawaharlal Nehru University (JNU), New Delhi), who chaired the session; Smt. Dipika Pandey Singh (Member of Legislative Assembly (MLA), Mahagama Constituency, Jharkhand; Secretary, All India Mahila Congress); Prof Irudaya Rajan (Professor, Centre for Development Studies (CDS), Kerala); Prof Vibhuti Patel (Former Professor, Tata Institute of Social Sciences (TISS), Mumbai); Shri Sameer Unhale (Joint Commissioner, Municipal Administration, Maharashtra); Dr Simi Mehta (CEO & Editorial Director, IMPRI; Fulbright Scholar, Ohio State University, USA); and, Dr Arjun Kumar (Director, IMPRI; China India Visiting Scholar (CIVS) Fellow, Ashoka University).

Comments